Lawmakers hope to modify crucial dates in reconciliation bill

Published in Political News

WASHINGTON — While efforts to sway initially reluctant GOP moderates and ultraconservatives to vote for the Republican reconciliation package resulted in a law with little wiggle room for change, some lawmakers are already working to find that room.

A few of the package’s health provisions took immediate effect, but implementation of the bulk of them begins between 2026 and 2028. Notable holdouts who had deemed changes to be essential in the shaping of the legislation are now seeking either to bring forward or push back those dates, depending on the provision.

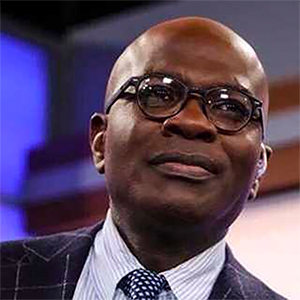

Sen. Josh Hawley, R-Mo., introduced legislation Tuesday aimed at mitigating the law’s impact on rural health facilities, one of his key concerns before he ultimately voted in favor of President Donald Trump’s signature law.

“Now is the time to prevent any future cuts to Medicaid from going into effect,” Hawley said in a release. “I want to see Medicaid reductions stopped and rural hospitals fully funded permanently.” His bill would roll back provisions that are slated to phase down health care provider taxes and state-directed payments in 2028 and would increase a Rural Health Transformation Fund to $100 billion to be used over 10 years instead of five.

“I didn’t like everything that was in there, so I shaped it to the extent I could,” Hawley said in an interview.

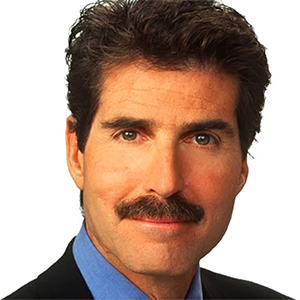

Rep. Jeff Van Drew, R-N.J., one of the more vocal House moderates on the need to change Medicaid provisions, said, “I don’t think we should cut hospital funding, and I wanted to make sure that our hospitals are funded for the long term.”

But he’s skeptical that Hawley’s approach will work.

“Politics is the art of the doable, and I respect Sen. Hawley very much. I think that’s going to be a hard goal to attain in both the House and the Senate,” Van Drew said. “If I was to look at something, it would be a little more practical.” Van Drew has praised the Senate’s move to delay implementation of the provider tax language by one year, allowing more time to examine if further delays are necessary, and the inclusion of a fix for local providers in the Senate wraparound amendment.

“Now we’re letting the dust settle,” said Van Drew, adding that most of the provisions affecting hospitals don’t take effect until 2028. “Let’s see how things go.”

Changes to the law outside of the reconciliation process would require Democratic buy-in in the Senate, given its 60-vote threshold. That could be surmounted, as some Democrats are quietly considering partnering with Republicans to a degree on mitigating the effects (though none interviewed Tuesday would speak on the record).

Sen. Thom Tillis, R-N.C., who voted against the reconciliation legislation due to concern over the Medicaid provisions, said he has not decided if he plans to introduce his own stand-alone Medicaid legislation. He said he plans to take a closer look at Hawley’s bill.

“The whole thesis behind my concern was the problem didn’t exist. So I guess first we’ve got to come up with an agreement on what problem we’re trying to fix,” Tillis said.

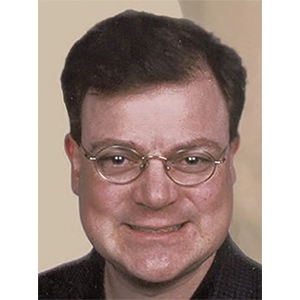

Sen. Rand Paul, R-Ky., and Rep. Greg Steube, R-Fla., meanwhile, have introduced legislation that would speed up implementation of a provision limiting coverage for certain immigrants and reduce the federal match for states that cover undocumented immigrants through Medicaid expansion.

Their legislation would move up the Medicaid coverage prohibition from Oct. 1, 2026, to July 4, 2025, the day Trump signed the bill into law. The federal match penalty language was ultimately removed to avoid violating the Byrd rule, which restricts nonbudgetary measures in reconciliation bills.

“The One Big Not-So-Beautiful Bill has been signed into law, but there’s a ridiculous delay until October 2026 before certain noncitizens are finally removed from Medicaid,” said Paul, who voted against the legislation. Steube voted in favor of the package.

It’s not unprecedented for Congress to delay more ambitious policies tucked into larger laws. The 2010 health law included the so-called “Cadillac tax,” a 40% excise tax on high-deductible health plans. Congress delayed the tax twice before repealing it in 2019.

_____

©2025 CQ-Roll Call, Inc., All Rights Reserved. Visit cqrollcall.com. Distributed by Tribune Content Agency, LLC.

Comments